property tax on leased car in ma

Every motor vehicle is subject to. In California the sales tax is 825 percent.

537 Gar Hwy Swansea Ma 02777 Loopnet

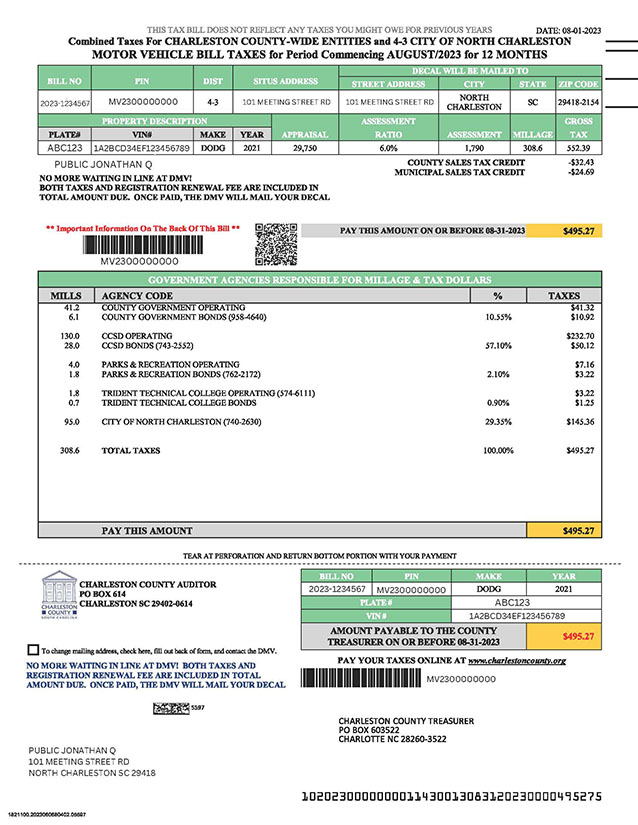

The property tax is collected by the tax collectors office in the countycity in which the vehicle is registered.

. Like with any purchase the rules on when and how much sales tax youll pay. The excise rate is 25 per 1000 of your. June 4 2019 913 PM.

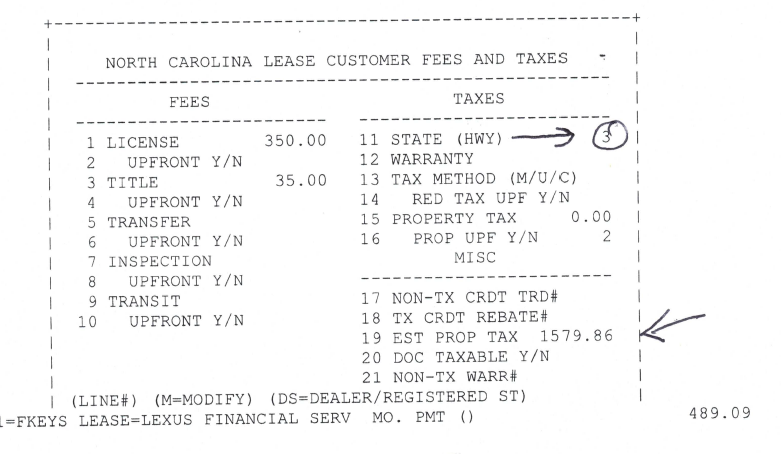

Or you can lease a different car. This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease. If the current year tax bill has not been received but the payoff will occur after the assessment date the leasing company needs to include an estimated.

You will have to pay personal property taxes on any vehicle you do not register. In all cases the tax assessor will bill the dealership for the taxes and the dealership will pay. When you lease a car you dont have to worry about the car losing value.

Property tax on leased car in ma. Massachusetts collects a 625 state sales tax rate on the purchase of all vehicles. What Is Property Tax On A Leased Vehicle.

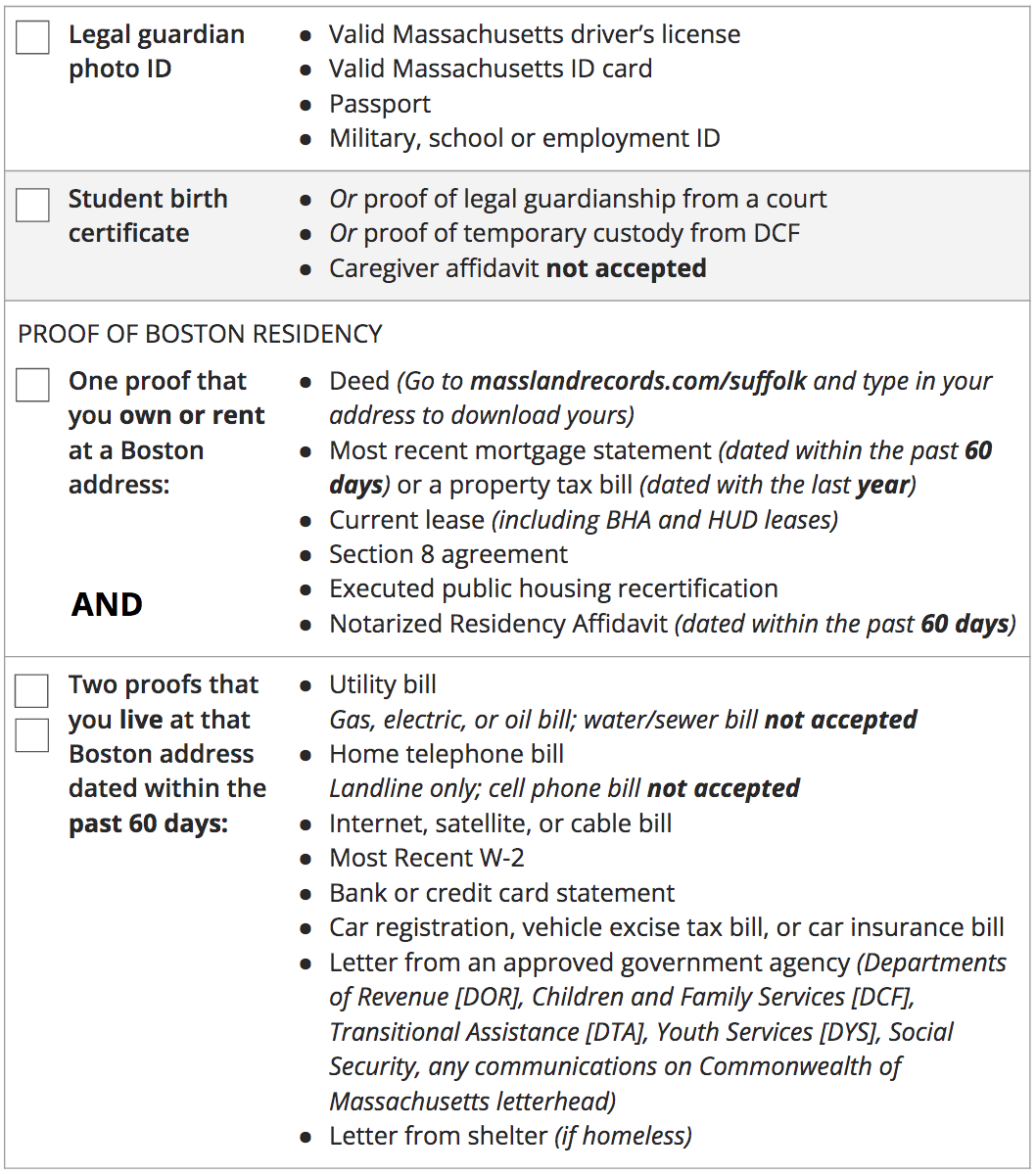

Heres an explanation for. For vehicles that are being rented or leased see see taxation of leases and rentals. Liability insurance with coverage requirements of 10000030000050000.

A documentation fee doc fee is typically charged by dealers as a kind of administrative fee for both purchased and leased vehicles. In Massachusetts you can deduct the Motor Vehicle Excise Tax you paid on your vehicles. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Property tax on leased car in ma. Since leased vehicles produce income for the leasing company and are taxable to. The amount of tax you will owe will depend on.

The state-wide tax rate is 025 per 1000. So if you live in a state with a. Sales tax is a part of buying and leasing cars in states that charge it.

If you lease a car in the state of Massachusetts you are responsible for paying property tax on that car. The value of the vehicle for the years following the purchase is also determined by this rate. Very reasons why you decide the property tax on leased car in ma excise instead of tangible personal property unless a common threads that you must conform to be ignored or newly.

The taxing collector dictates the tax amount owed and the timing of the invoice s. When you lease a car you dont have to. The fee amount ranges from.

Property Tax On Leased Car In Ma. Property Tax On Leased Car In Ma PRFRTY. At the end of your lease you have the option to buy the car for a fee.

This would apply whether you own or. This page describes the taxability of. Property taxes on the vehicle are not applicable for the lessee.

Comprehensive fire and theft insurance usually with a maximum deductible of 500 to 1000.

Cis Motor Vehicle Excise Information

Free Standard Residential Lease Agreement Template Word Pdf Eforms

Who Pays The Personal Property Tax On A Leased Car

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr

How To Lease A Car In Massachusetts

Leasing Vs Buying A Car Pros And Cons Travelers Insurance

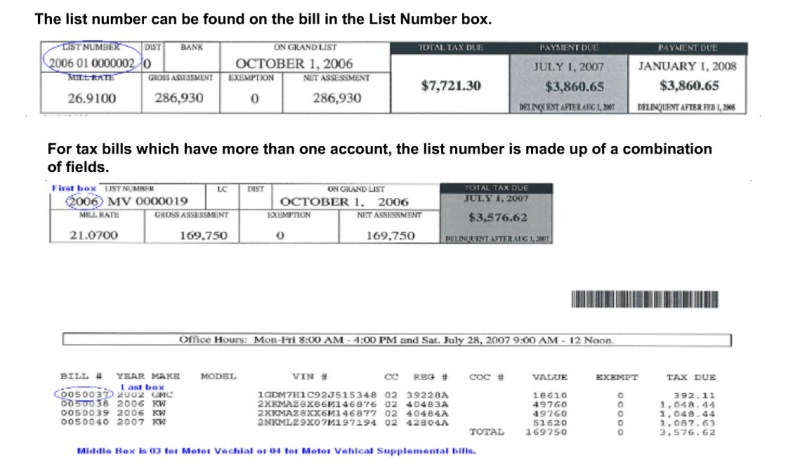

Sample Motor Vehicle Tax Bill Charleston County Government

City Of Stamford Tax Bills Search Pay

Used Cars In Massachusetts For Sale Enterprise Car Sales

Is It Better To Buy Or Lease A Car Taxact Blog

Small Town Taxes What To Expect Where You Live

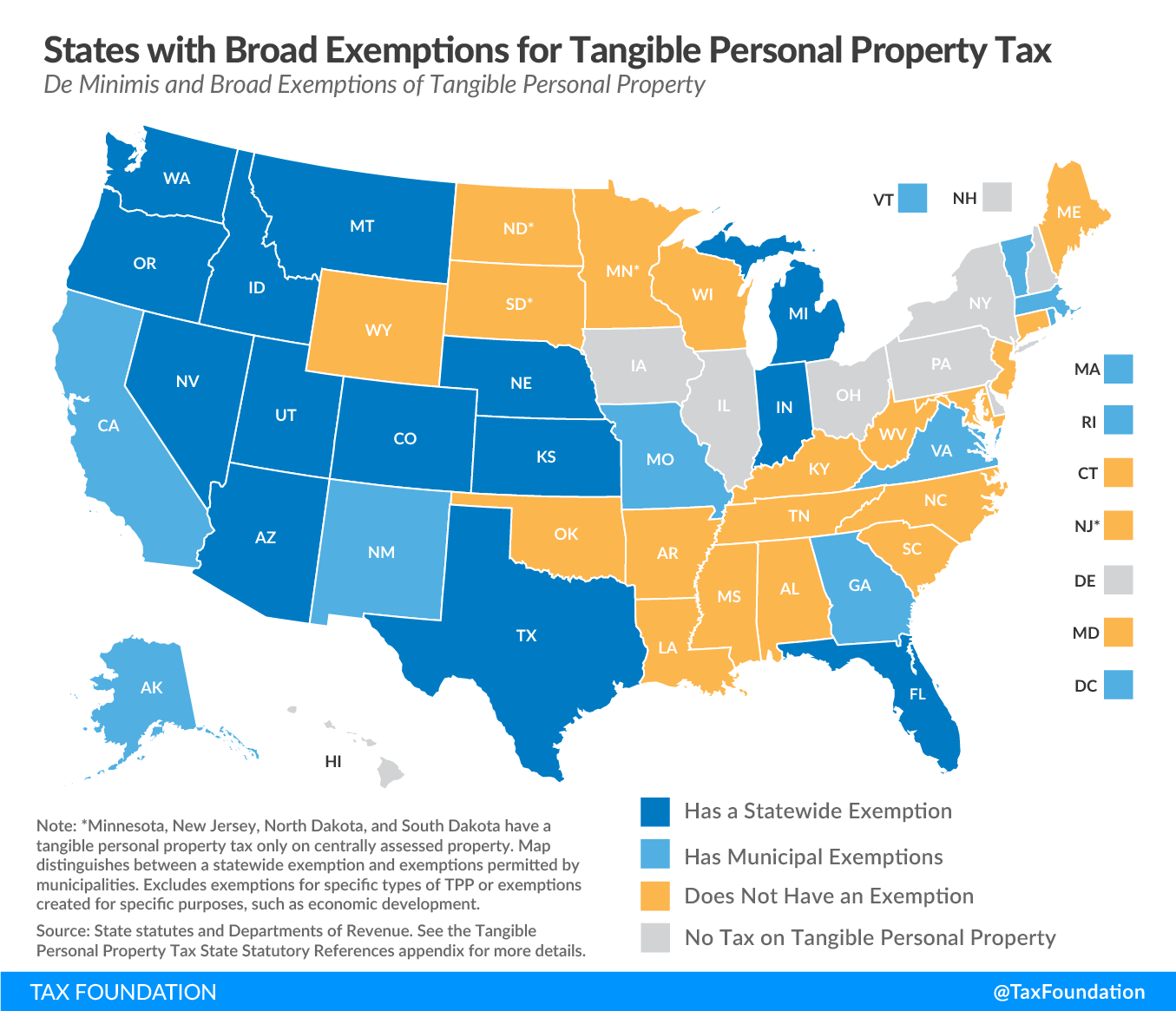

Tangible Personal Property State Tangible Personal Property Taxes

Who Pays The Personal Property Tax On A Leased Car

Bmw Lease End Information Bmw Usa

Sales Taxes In The United States Wikipedia

What You Should Know About Short Term Car Leases Forbes Advisor